gift in kind letter

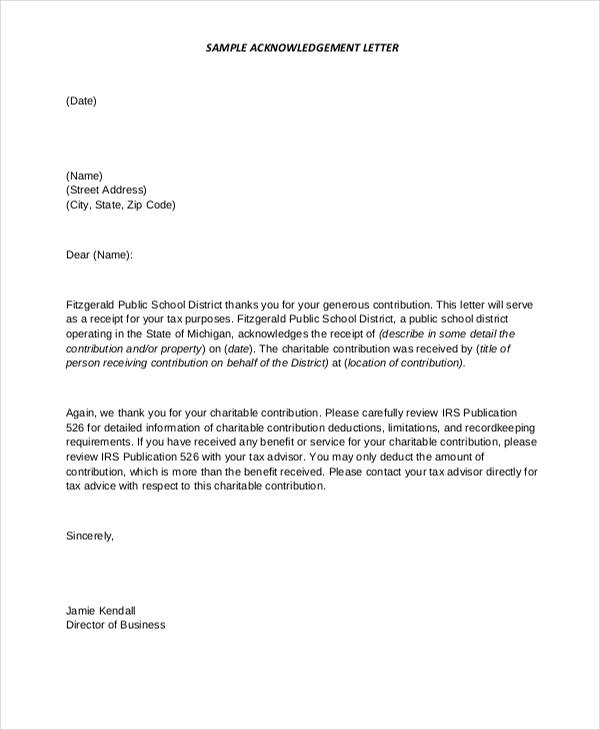

Gifts of service If a noncash gift is a service eg a donor is an electrician who installs a light fixture in the narthex the donor cannot deduct the value of his or her time or services. Prompt and thoughtful gift acknowledgments are central to effective fundraising.

Tulsa Quilt Maker Receives Letter From Buckingham Palace Ktul

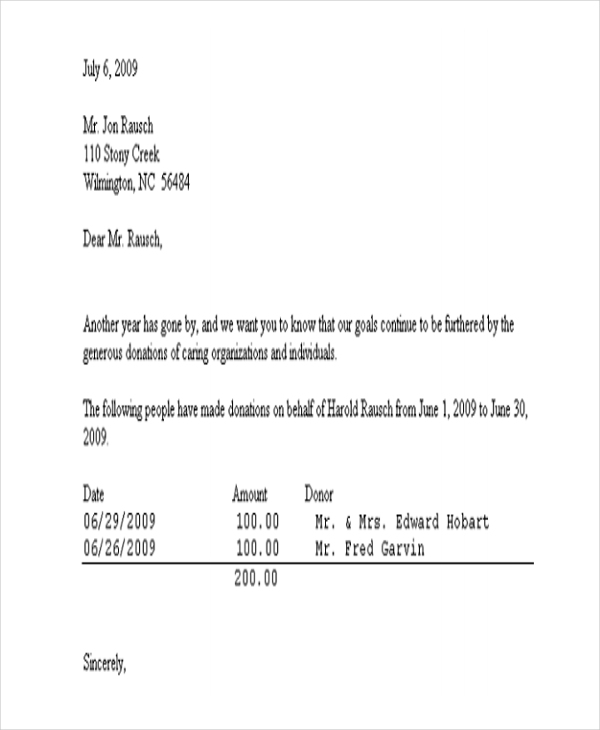

This article explains different types of donation letters and gives examples of how organizations have.

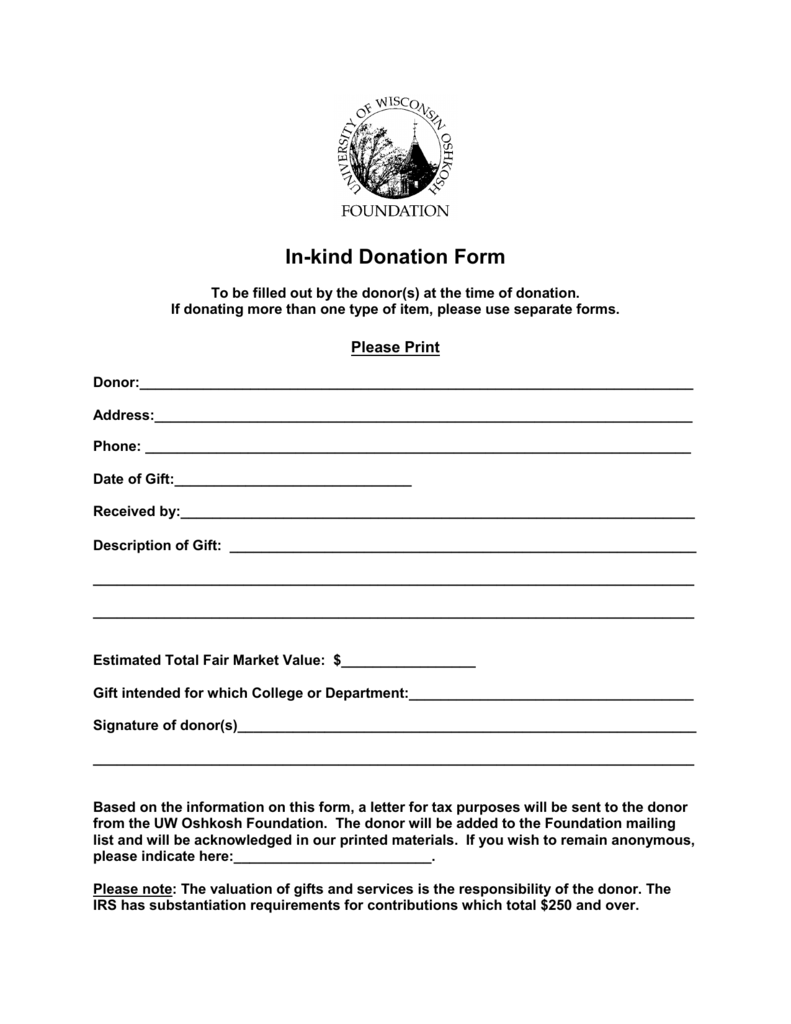

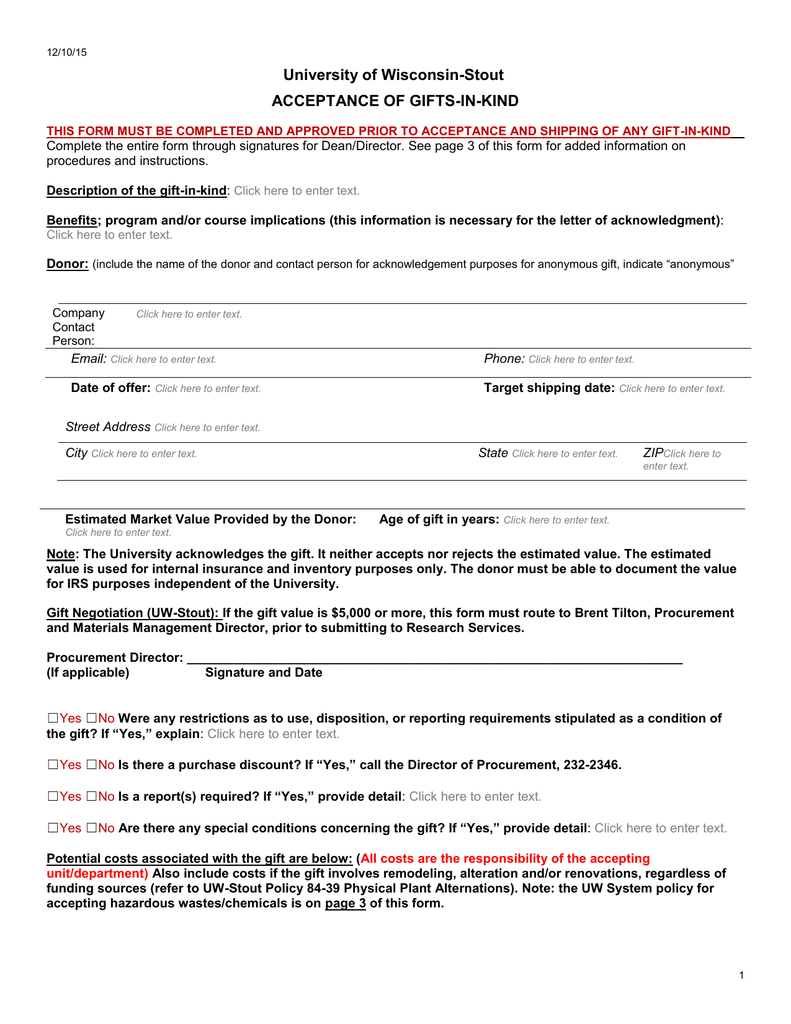

. Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an important source of financial support for nonprofits. While determining the fair value of cash. NEA 3716 SAMPLE IN-KIND CONTRIBUTION FORMS Page 4 of 5 EXAMPLE A GRANTEE ORGANIZATION.

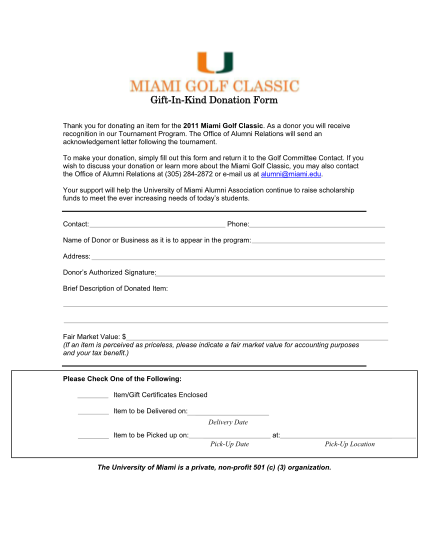

Generally a donor may deduct an in-kind or non-cash donation as a charitable contribution. An in-kind donation is a non-monetary gift of a product or service to a nonprofit from an individual a business or a corporation. But as you know with in-kind contributions.

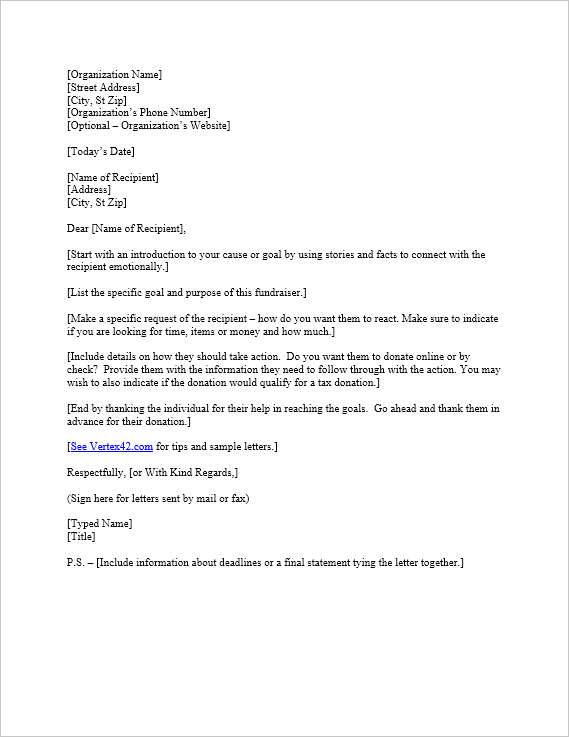

These may seem like an afterthought but it is actually very important to include all of the following information in your in-kind donation acknowledgment letter. It can be tangible clothing books bicycles. A well-thought-out and authentic letter leaves a positive impression on the receiver and will help you stand out among the hundreds of requests that the donor might be.

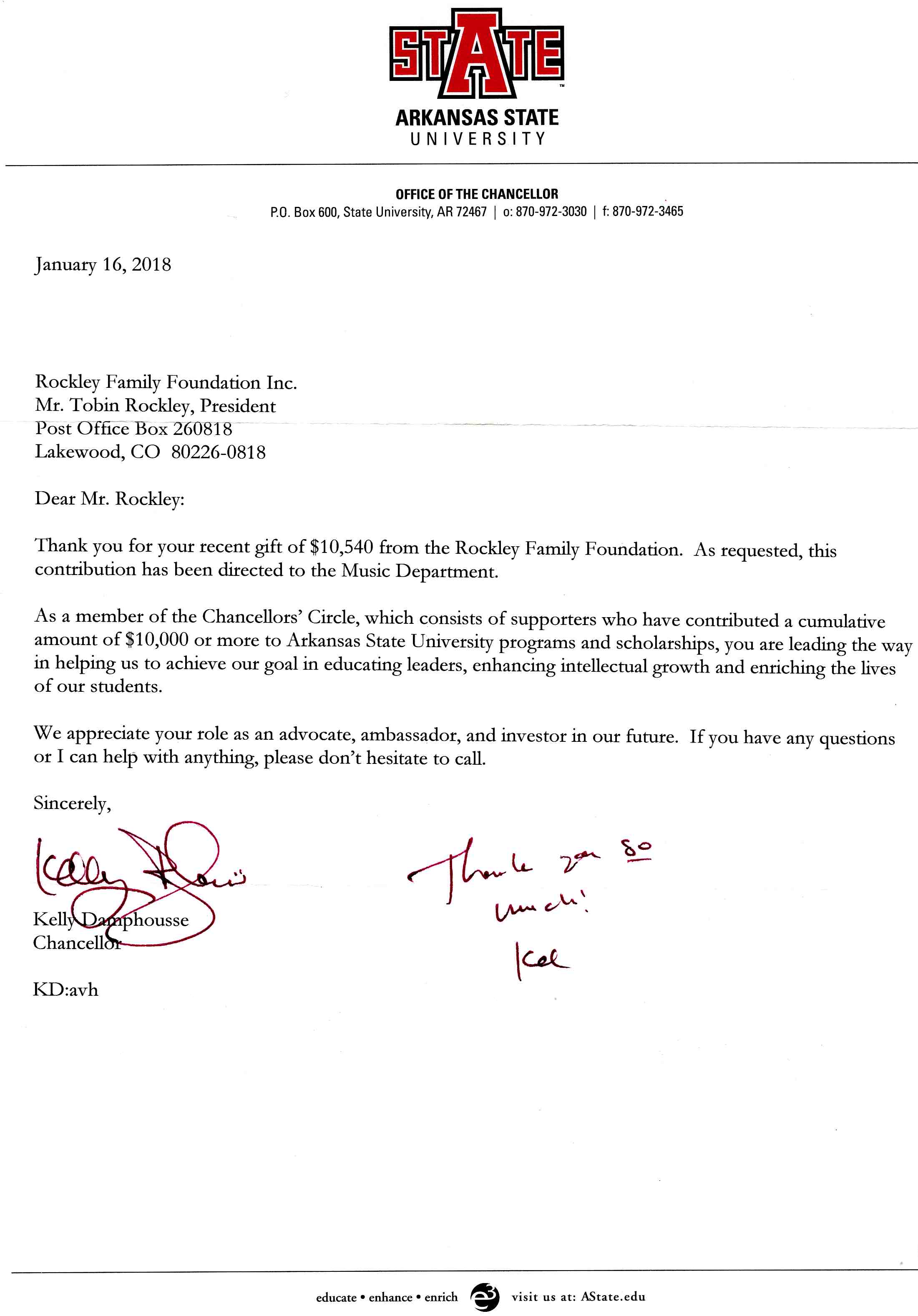

And a donor must obtain a written acknowledgment from the charity to. We have written an article on writing fundraising letters in the past. When you receive gifts of products time and services be aware that your organization can be held in even greater regard by donors of such In-Kind gifts should you.

Italys ex-premier Silvio Berlusconi was under fresh scrutiny Wednesday over his friendship with Vladimir Putin after being recorded describing a birthday present of. Of course if cash you specify the amount. Having a well-crafted appeal letter for in-kind donations is a must to ensure your organization receives the support it needs.

For in-kind contributions companies typically can choose to write off products provided to charitable events or programs as either a marketing expense or charitable. Museum of Art NEA Award. Simply put the IRS will only recognize any donation as it is acknowledged by an accredited non-profit.

Use the following six tips to gain more support when writing your. IRS regulations govern what documentation donors need in order to claim a deduction for their charitable.

/lettertocorporation-56a6adf53df78cf7728fb2d6.jpg)

Sample Gift In Kind Donation Letter Request

30 Editable Solicitation Letters Free Samples Templatearchive

Gift Acknowledgement Letter Templates 5 Free Word Pdf Format Download Free Premium Templates

Writing A Thank You Letter For Gift 14 Best Examples

Instrument Donation Acknowledgements Rockley Family Foundation

5 Donation Acknowledgement Letter Templates Free Word Pdf Format Download Free Premium Templates

Free 9 Sample Thank You Letters For Gifts In Ms Word Apple Pages Google Docs Pdf

Free Request For Donation Letter Template Sample Donation Letters

The Best Christmas Gift North Pole Santa Letters

How To Write The Best Thank You Letter For Donations Three Templates And Samples

Donation Solicitation Letter Template Parent Booster Usa

Your Complete Guide To In Kind Donations

Donation Thank You Letter Template Lovetoknow

In Kind Donation Receipt Template Printable Pdf Word

All About In Kind Donations With Sample Thank You Letter Postcard Moneyminder

University Of Wisconsin Stout Acceptance Of Gifts In Kind

29 Donation Thank You Letter Free To Edit Download Print Cocodoc

In Kind Donation Thank You Letter Template Lomer With Donation In Kind Letter Template In 2022 Thank You Letter Template Thank You Letter Thank You Letter Examples