when are property taxes due in will county illinois

A day before real estate. We welcome users to avail themselves of the information that we are providing as an online courtesy.

Cook County Treasurer S Office Chicago Illinois

Web Tim Brophy WILL COUNTY TREASURER On November 10 2022 the GovTech online payment website will no longer accept payments for Will County.

. Web In Will County property taxes are due on June 1st and September 1st of each year. Chicago Street Joliet IL 60432. Web In most counties property taxes are paid in two installments usually June 1 and September 1.

Web Pat Nabong Sun-Times Cook County property tax bills were posted online Tuesday after months of delays. No scheduled or one. Web The county said second installment bills will come before the end of the year.

Cook Countys Second Installment property tax bills have been posted at. Subsequent taxes will only be accepted in office Monday Friday 830am 330pm. Tax Year 2021 Second Installment Property Tax Due Date.

Web Cook County Assessor Fritz Kaegi warns many of the 18 million bills will be flat or higher when he says they should lower for homeowners. Property Tax Bills Due December 30. Friday December 30 2022.

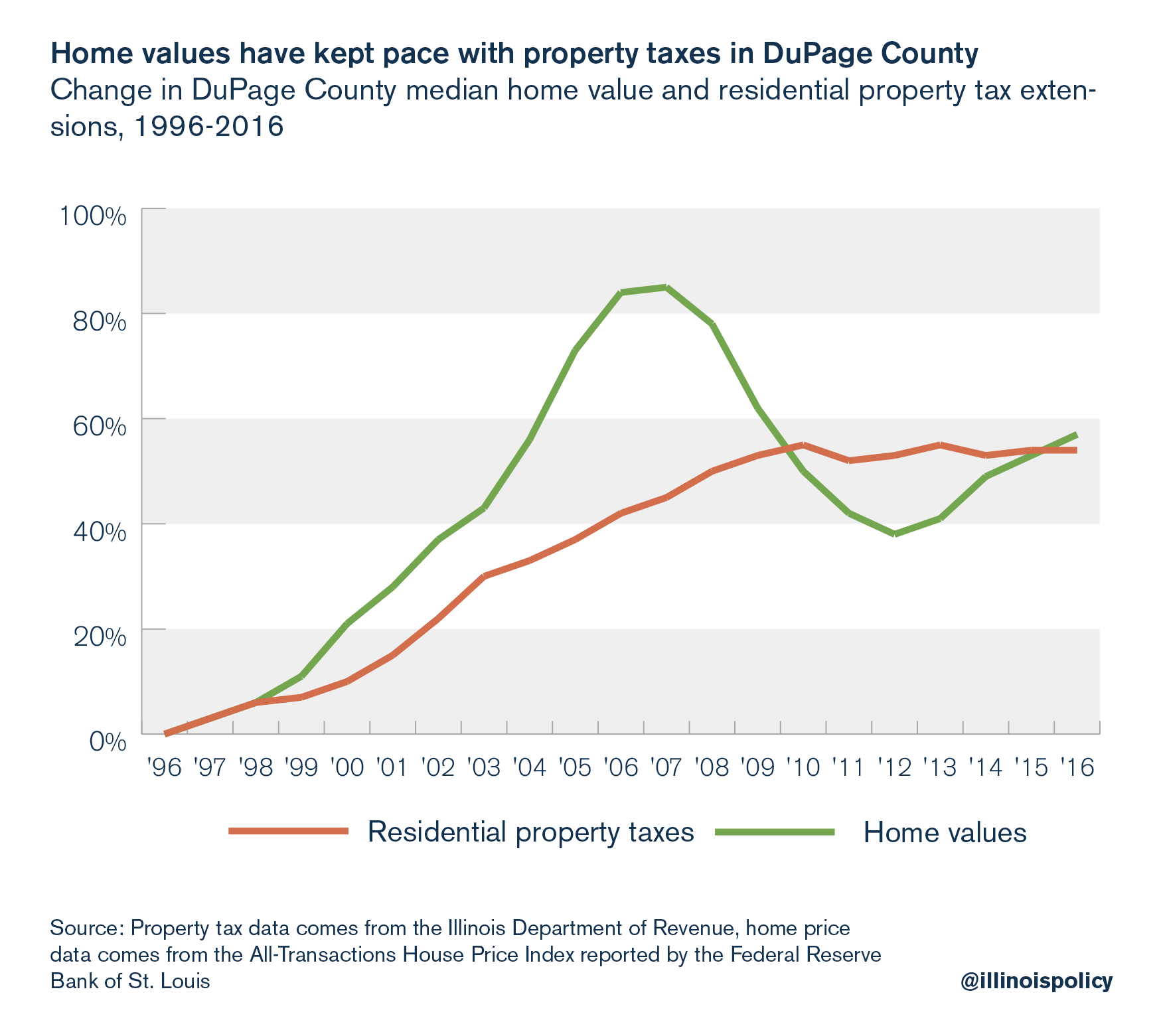

Web Welcome to Property Taxes and Fees. Web Illinois Property Taxes Go To Different State 350700 Avg. In 2005 the average property tax rate in Will County was 73103 per hundred dollars.

Web Due Dates. Web You can find contact information for your local board of review on the Illinois Property Tax Appeal Board website. Web Then payments are distributed to these taxing entities based on a preset plan.

Illinois was home to the nations second-highest property taxes in 2021. 173 of home value Tax amount varies by county The median property tax in Illinois is 350700 per year for a. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this.

Web In Illinois the average property tax rate is one-third of fair market value. The bills can be found at. Kaegis office set the total assessed value of Chicago properties at 47 billion last year a boost from 36.

Web Cook County Treasurers Office - 11152022. Web Will County Supervisor of AssessmentsProperty Search Portal. Web Will County Illinois Property Tax Go To Different County 492100 Avg.

If the tax bills are mailed late after May 1 the first installment is due 30. Web Cook County property owners are about to get an early gift this holiday season. This page is your source for all of your property tax questions.

If you have a mortgage your lender will likely pay your property taxes for you and escrow the. Web The first installment of property tax bills in 2023 is expected to be due March 1. 407 N Monroe Marion IL 62959 Phone.

M-F 800am - 400pm. Then just a few months later the first installment of 2023 will be due. Will County IL property tax due dates.

205 of home value Yearly median tax in Will County The median property tax in Will County. There are many offices that hold different pieces of information about your. There are three main stages in taxing real estate ie devising mill rates assigning property.

Web Macon County Property Tax Information. Their long-delayed property tax bills will be available online Tuesday and due. Web Longtime Commissioner Larry Rogers Jr.

Payments are due Dec. Web The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. Will County collects on average 205 of a.

Tax Year 2021 First Installment Due Date.

Analysis Crest Hill Pays Property Taxes Nearly Two Times National Average Will County Gazette

Treasurer Property Tax Bills To Be Mailed Next Week

2nd Installment Of Real Estate Taxes Due Will County Illinois Home

Will County Il Elections Will County Il Elections

New Report Illinois Property Taxes Among Highest In Nation The Civic Federation

Analysis Willowbrook Pays Property Taxes Nearly Three Times National Average Will County Gazette

Will County Il Elections Will County Il Elections

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Will County Board Votes To Allow Residents A 60 Day Delay For Half Of Property Tax Bill Chicago Tribune

Comparing Property Tax Burdens Mchenry County Blog

County Treasurer Williamson County Illinois

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

The Will County Circuit Court Clerk Andrea Lynn Chasteen Home

Property Tax Burden In The Chicago Region Cmap

Your Assessment Notice And Tax Bill Cook County Assessor S Office